1.Investment Planning

Most private clients understand the process and procedures behind investment planning. Still other novices or beginner investors don’t grasp the concept of what investment planning truly is. So just “what is investment planning”?

Investment planning is the process of matching your financial goals and objectives with your investment resources. It’s critical to note that investment planning IS A SUBSET OF financial planning. Good investment planning cannot be done without a great financial plan first!

2.Insurance Planning

Insurance planning is a critical component of a comprehensive financial plan. At M Financial Planning Services, we advise our clients on how to grow and protect their wealth. Proper risk management and insurance planning are necessary to financial success.

We utilize the following insurance strategies:

- Individual Life Insurance

- Disability Insurance Planning

- Long-Term Care Insurance

- Group & Business Insurance

Closing the gap on potential risks can be tricky without a comprehensive plan that includes evaluating risks and determining the proper insurance coverage to mitigate those risks.

3.Tax Planning

Tax planning is a process of analyzing one’s financial situation logically with a view to reducing tax liability. Tax planning involves planning your income in a legal manner so to avail various exemptions and deductions. Under Section 80C, you can avail tax deduction if specific investments are made for a specific period up to a limit of Rs 1, 50,000. The most popular methods for saving tax are investing in PPF accounts, National Saving Certificate, Fixed Deposit, Mutual Funds and Provident Funds. Tax planning involves applying various advantageous provisions which are legal and entitles the assesse to avail the benefit of deductions, credits, concessions, rebates and exemptions. Or we can say that, Tax planning is an art in which there is a logical planning of one’s financial affairs in such a manner that benefits the assesse with all the eligible provisions of the taxation law. Tax planning is an honest approach of applying the provisions which comes within the framework of taxation law.

Here are the three types of tax planning:

1. Purposive tax planning

2. Permissive tax planning

3. Long range and Short range tax planning

4.Real Estate Planning

Real estate is the land along with any permanent improvements attached to the land, whether natural or man-made—including water, trees, minerals, buildings, homes, fences, and bridges. Real estate is a form of real property. It differs from personal property, which are things not permanently attached to the land, such as vehicles, boats, jewelry, furniture, and farm equipment.

KEY TAKEAWAYS

- Real estate is a class of “real property” that includes land and anything permanently attached to it, whether natural or man-made.

- There are five main categories of real estate: residential, commercial, industrial, raw land, and special use.

- You can invest in real estate directly by purchasing a home, rental property or other property, or indirectly through a real estate investment trust (REIT).

5.Children Future Planning

Planning for your child’s future is a much common concern, which continues to exist in the hearts of every parent. Parents in no way want their children with the same pains, hardships, shortage of money and resources, which were once experienced by them. None of the other joys carry enough potential to please parents than seeing their own children growing not only physically but financially also. As a parent if you have started experiencing the hindrances in relation to the development, education and marriage of your children then you are surely in need of children’s future planning.

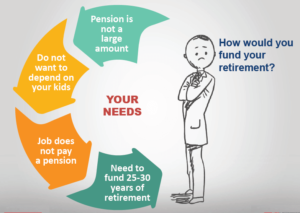

6.Retirement Planning

Retirement planning is the process of determining retirement income goals, and the actions and decisions necessary to achieve those goals. Retirement planning includes identifying sources of income, sizing up expenses, implementing a savings program, and managing assets and risk. Future cash flows are estimated to gauge whether the retirement income goal will be achieved. Some retirement plans change depending on whether you’re in, say, the United States, or Canada, which has its own system of workplace-sponsored plans.

KEY TAKEAWAYS

- Retirement planning refers to financial strategies of saving, investment, and ultimately the distribution of money meant to sustain one’s self during retirement.

- Many popular investment vehicles such as IRAs and 401(k)s allow retirement savers to grow their money with certain tax advantages.

- Retirement planning takes into account not only assets and income but also future expenses, liabilities, and life expectancy.

- It is never too early—or too late (although earlier is better)—to start retirement planning.

7.Cast Flow Planning

Cashflow planning entails forecasting and tabulating all significant cash inflows relating to sales, new loans, interest received etc. and then analyzing in detail the timing of expected payments relating to suppliers, wages, other expenses, capital expenditure, loan repayments, dividends, tax, interest payments etc.